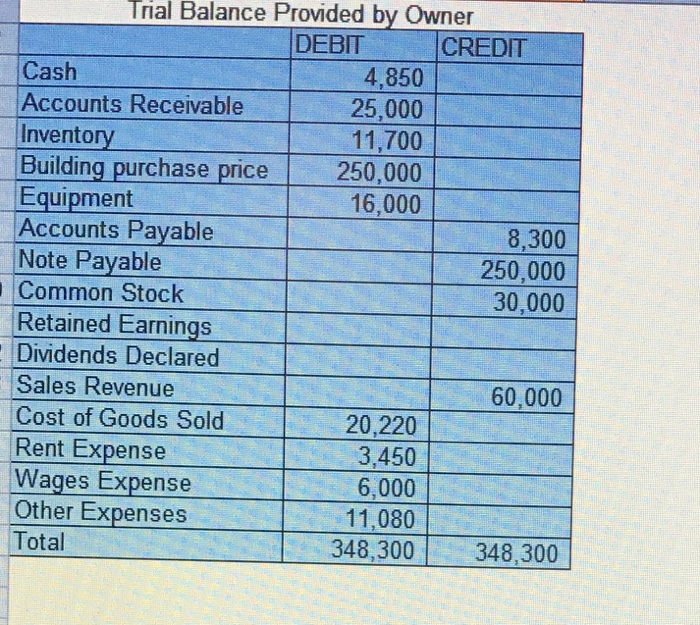

Credit And Debit Trial Balance

ADVERTISEMENTS: When ledger postings are completed and accounts are balanced, the next phase in the accounting cycle is preparation of a Trial Balance. This phase helps to verify whether sum of the debit balances is equal to the sum of the credit balances. This is an essential phase before proceeding further to prepare the final accounts at the end of accounting period. However, Trial Balance is generally prepared at quarterly interval in practice to check the arithmetic accuracy of accounts. Trial Balance is a statement of ledger balances at a particular point of time. At all points of time sum of all debit balances must be equal to sum of all credit balances.

Trial balance is prepared for the following purposes. ADVERTISEMENTS: 1.

To check the arithmetic accuracy of ledger balances: When a trial balance is tallied, i.e., when sum of all debit balances equals the sum of all credit balances, there is a prima facie evidence that ledger accounts are arithmetically correct. (However, there are certain types of errors which may remain despite of the fact that the Trial Balance has been tallied). To finalize the accounts easily: In the Trial Balance all ledger balances are arranged in accordance with their nature. This means all debit balances and credit balances are properly categorized and put together. So while finalizing accounts, the accountant can proceed with the Trial Balance without referring to voluminous ledger accounts again and again.

ADVERTISEMENTS: 3. To ensure that Balance Sheet will tally: Balance Sheet has also two panels (but remember balance sheet is not an account). The lower panel is for ‘Equity and Liabilities’ and the upper panel for ‘Assets’. You have learnt that Equity + Liabilities = Assets at all points of time.

Totaling of all debits and credits in the general ledger at the end of a financial period is known as trial balance. 'Day Books' or journals are used to list every single transaction that took place during the day, and the list is totalled at the end of the day.

So both sides of Balance Sheet are always in balance. Trial Balance provides a first trial and ensures that Balance Sheet will balance. Advantages of Trial Balance: The following are the advantages of preparing a Trial Balance: 1. This helps to check arithmetic accuracy of ledger accounts.

ADVERTISEMENTS: 2. This helps to detect errors. This helps to identify income, expense, assets and liabilities easily since debit and credit balances are arranged separately. It is a basis for preparation of final accounts. Techniques of Preparing Trial Balance: Preparation of Trial Balance is the Third Phase in the accounting process the first two are: (i) Journalisation, and (ii) Ledger posting and balancing.

A trial balance is prepared whenever it is necessary to finalize accounts. Alternatively, it is possible to have an in-built mechanism by which Trial Balance can be prepared on a daily basis. To prepare quarterly Trial Balance all accounts are balanced at the end of the accounting period. Thereafter the balances are arranged in accordance with their nature, i.e., debit balance and credit balance. While preparing a Trial Balance, the following steps should be followed: 1.

All the ledger accounts including cash and bank are to be entered in the Trial Balance in accordance with their nature. Autocad total length command. The accounts having debit balances appear under the heading ‘Debit balances’ and the accounts having ‘credit balances’ appear under the heading ‘Credit balances’ (see Exhibit TB.1). Alternatively, all the accounts may appear under the common heading ‘Ledger balances’ (see Exhibit TB.2).

All ledger balances excepting debtors and creditors are scanned and entered against the respective accounts in the Trial Balance. Balances of individual debtors are added together and shown as sundry debtors or simply Debtors. Balances of individual creditors are added together and shown as Sundry Creditors or simply Creditors. Debit balances and credit balances are totaled separately to produce the Rough Trial Balance. End of accounting period transactions and events are journalized and posted in the appropriate ledger accounts. Ledger balances are redrawn after such adjustments. Ledger Balance as per the Rough Trial Balance are changed wherever necessary.

Debit balance and credit balance are totaled separately to produce the Final Trial Balance. This becomes a basis for the preparation of final account.

First Alternative: Second Alternative: In the first alternative (Exhibit TB.1), accounts showing debit balances and credit balances are shown separately. Debit balances are shown on the left hand side while the credit balances are shown on the right hand side.